Fees and Funding

Ramillies Hall Nursery – Fees and Funding

Ramillies Hall Nursery – Fees and Funding

Whether you are a newcomer to our nursery or a familiar face within our community, understanding Early Years Funding can be quite perplexing, especially with the recent changes. We hope the information provided below will clarify the various funding options available to support your childcare costs. We will explain the Government's early years funding schemes, how they integrate with our own fee structure, and how you may potentially lower your expenses through Tax-Free Childcare.

Government Funding Explained

Working Family Funded Childcare

Starting September 2025, children of eligible parents will be able to access 30 hours of funded childcare for 38 weeks each year, beginning from the start of the term after the child turns 9 months old.

The funded hours are available either during term time for children on a term-time-only contract, or can be spread out over 50 weeks for those on an all-year-round contract.

To qualify parents should:-

- Be working at least 16 hours a week

- Can be on sick leave or parental leave

- Must earn less than £100,000 a year

- Might still be eligible while claiming benefits.

You can check your eligibility on the government website www.beststartinlife.gov.uk

Universal funded childcare for 3 year olds

All parents are eligible for this scheme, which provides 15 hours of funding for 38 weeks each year, starting from the term following their child's third birthday. The funded hours are available during term time for those on a term-time only contract, or they can be 'stretched' over 50 weeks for children on an all-year-round contract.

For children aged 2 years receiving additional forms of support

An additional scheme is offered by the Government for 2 year olds who qualify for example if:-

- Parents are receiving certain benefits

- The child qualifies for Disability Living allowance or has an EHCP

- The child has a kinship or guardianship order

- The child is being looked after by a local authority.

The nursery can provide a limited number of places under this scheme, depending on availability. Children may only utilise the free hours offered by this scheme, and there will be no extra charges unless additional hours are needed.

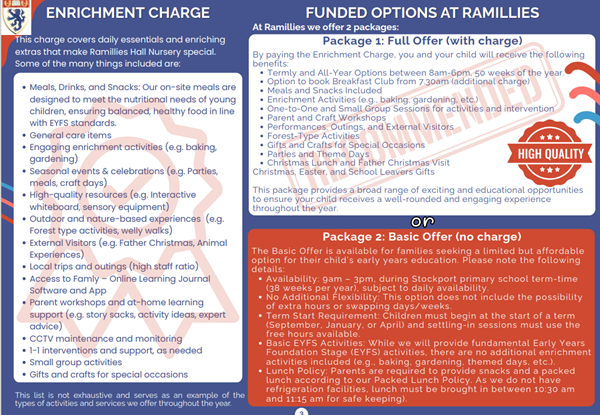

Ramillies Hall Fees

The Government funding significantly eases the financial burden of childcare, but it covers only a limited number of hours and provides only for a basic level of care. At Ramillies, we take pride in giving your child the best possible start in life through a wide range of enriching experiences, nutritious home-cooked meals and snacks, and staff-to-child ratios that exceed legal requirements. By choosing our setting and accessing its full provision, you acknowledge that although you will not be charged for the funded hours, you will incur costs for any additional hours and for the enhanced provision we offer. A fully funded basic package is available for those who do not wish or unable to pay additional costs.

We require that your child attends a minimum of 20 hours with us. This gives your child the opportunity to really settle at the nursery and benefit from all that we have to offer. Eligible parents can utilise 15 hours of funding to reduce costs; however, any additional hours will be charged at our standard hourly rate, along with a weekly consumables fee.

We would love for your child to spend more days with us. For parents whose children attend for 30 hours or more, the 30 hours of funding can help offset some of the associated costs. Nevertheless, please note that any additional hours will still be charged at our normal hourly rate, along with the weekly consumables fee.

Term Time or All Year Round

At Ramillies we are able to offer all children either a term time contract (39 weeks of the year) or an all year contract (50 weeks of the year – the nursery is closed for a week at Christmas and at the end of August). Please see fees sheet for associated costs for each kind of contract.

For children attending term time only, the 15 hours or 30 hours is spread over 39 weeks (an equivalent of 14.6 hours per week or 29.23)

For children attending all year round, the funding is stretched over 50 weeks (an equivalent of 11.4 hours or 22.8 hours per week).

Tax Free Childcare

Working parents can receive up to £2000 per child, per year, for children under the age of 12 by taking advantage of the Government’s Tax-Free Childcare Scheme. As an approved provider, we can accept payment via this method. More information about this can be found at www.childcarechoices.gov.uk